Asian sand wars, liquid sovereignty, creating land from ocean, concept change, borders, states, real estate development, Singapore, web of processes, cluster, interests, floating structures, floating real estate, liquid real estate, political power and real estate development, broker business interests, incremental approach, ramform seastead, old state theories threatened by new technology, investments and sandbank real estate…

in this context also read : | extraterritorialized extra state enclaves |

basic ocean colonization concepts:

/ Lens shell pictures overview / / Ramform floating home pictures / / c-shell floating home pictures / / Floating concrete building methods / / shell cluster pictures / / investor proposal list /

- Dubai sandbank building projects

- What needs to be done to make seasteading investment worthy

- Blockchain things upcomming things falling apart

Built on Sand: Singapore and the New State of Risk

Joshua Comaroff

In June 2014, drivers crossing the causeway between Singapore and Johor, Malaysia, began to notice something strange. A slender sandbar, which had long stood in the middle of the narrow straits, had started to grow, and was slowly inching toward Singapore. Construction vehicles had arrived, and small barges passed continuously, dumping load after load of sand into the water. Newspapers soon reported that this expanding mound was to become the site of Forest City, a 2,000-hectare high-rise housing development jutting out from the Malaysian port of Tanjung Pelepas. As this privately funded project crept toward Singapore’s national border, the security state doubtlessly felt violated. In response, Prime Minister Lee Hsien Loong requested that the Malaysian government halt work on the project, and threatened to file a complaint with the International Tribunal for the Law of the Sea in Hamburg.

https://r6r4i4n7.stackpathcdn.com/wp-content/uploads/johor-bahru-forest-city.jpg

Forest City Singapore, Real Estate created from waterspace…

Forest City and its backstory are emblematic of an emerging issue of a transnational order. Less obvious than the increased capital flows across territories is the flow of territory itself. That is, land. Or, more accurately, sand.

With the rise of sand trading, the nation-state has entered a dangerously fluid phase. With the coastal earthworks that are under way throughout Southeast Asia and the Middle East—a series of reclamations so large that they nearly encroach on sovereign borders—territory has acquired an unprecedented liquidity. The malleability of sand makes it a uniquely volatile substance. Its softness and scalability distinguish it from other modes of infrastructure. As journalist Chris Milton pointed out in a 2010 essay in Foreign Affairs, sand is a medium by which massive environmental change can be effected via incremental processes.1 It is granular—neither liquid nor solid—which means that it can be transported by the boatload or by the handful. In large quantities, it can be engineered into the most fundamental of all infrastructures: land itself. In contrast to the materiality of other “fixed” infrastructures, however, sand is removed and sold by a great number of agents, and is brokered by governing authorities at local and national levels. Many dealers are illicit, and allegedly trade without genuine receipts. As such, the transnational drift of sand leaves only the most fragmentary of traces. Disappearances are difficult to map and nearly impossible to quantify. A number of importers, including Singapore, consider the details of their sourcing to be confidential and a matter of national security. In this context, the physical basis of the state can be incrementally eroded or expanded, legally or otherwise, through the work of private actors—much to the benefit of expanding nations. It is a form of appropriation that differs rather dramatically from traditional seizures of territory, through war or colonial expansion.

Forest City Plans

Nowhere is Milton’s observation more true than in Singapore, where access to sand has become a matter of national security; it is the key currency in a new geopolitics of risk. The “Little Red Dot” has, since 1965, dilated from 224.5 to 276.5 square miles. The target of a 30 percent (or three square mile) increase of the country’s original land area has been set for 2030. Much of this city’s Central Business District, and its showpiece Gardens by the Bay, occupy what were the straits separating Singapore and Indonesia at the time of independence from Britain. Singapore’s sand works, geographical in scale, have exceeded even the figural archipelagos of Dubai’s trophy housing boom.

The island’s expansion has been a colossal undertaking. It is not merely a matter of coastal reclamation: Singapore is growing vertically as well as horizontally. This means that the nation’s market needs fine river sand—used for beaches and concrete—as well as coarse sea sand to create new ground. And the ground must be solid, as the lion’s share of Singapore’s architecture is high-rise. Foreign sand and aggregate, along with foreign labor, are essential in replicating the island’s ground in the sky. Both supply a burgeoning condo market and the ongoing rollout of a public housing program that serves more than 80 percent of the population.

For Singapore’s government, sand security is a safeguard of the state’s right to development. It is a precondition of fiscal and political survival. Sand, like money, must remain liquid for the economy to keep moving. The vulnerability of the island, its entropic tendency toward general decline, has long been imagined as a byproduct of its physical limits. The ruling People’s Action Party, which lays claim to the success of the housing initiative, has asserted time and again that the endurance of the nation depends upon a continual expansion of its market and its population. Both require Lebensraum. For this reason, sand and aggregate are stored in vast stockpiles in the areas of Seletar and Tampines, and are sold to contractors when regional disputes threaten the availability of the material. Paradoxically, the management of coastal risk comes to greatly affect the territory’s interior. The large tracts of land dedicated to storing sand and gravel aggregate become securitized sites—their area is taken “off the map.” The interior is leveraged such that the coast may grow.

The need for sand, then, is a kind of original debt: for the territorial state to survive, land must continually be introduced. Milton notes that .

6 miles of new ground requires 37.5 million cubic meters of fill—around 1.4 million dump trucks’ worth. This translates into a de facto transfer of territory from other countries. Despite the accepted terminology, earth cannot be “reclaimed” from the ocean by the magic of sovereign right; it needs to be brought from somewhere.

Unsurprisingly, this process of expansion has become a regional sore point—whetting old tensions between the island republic and its neighbors. The geopolitical narrative is that Singapore, in an undiscriminating fever of consumption, has begun to absorb surrounding territory. In a climate of heated diplomatic exchanges, fewer options for legal imports remain. Malaysia ceased shipments of sand to Singapore as early as 1997; Indonesia instituted a similar ban after claims that several of its Riau Islands had vanished, only to reappear as part of the Singapore coastline; and Vietnam suspended dredging in 2009. In turn, Myanmar and the Philippines have become principal sources. Cambodia also announced a freeze on river sand in 2009, but so much continued to disappear that locals joked of traveling to Singapore to plant the Cambodian flag.

Recently, nationalistic outrage has been joined by environmental concern, most pointedly the loss of fragile coastal habitat and sea-grass colonies. Many accusations allege ongoing smuggling from embargoed nations, as well as dredging at both seaside and river locations. Singapore, in keeping with its policy of transparency, has replied that it pursues its imports through lawful channels.

The island nation is hardly alone in its addiction. Sand has been called the “most wanted raw material on the planet.” Not only is it essential for construction, it is a key ingredient in the microprocessors and memory chips used in nearly all computer technology. Its legal trade is estimated at $70 billion per year. Environmental consultant Kiran Pereira figures the global annual sand consumption to be in excess of 15 billion tons.4 Even Dubai imports sand for construction, as do most other regions that build chiefly in concrete. Many of the nations that export sand to Singapore also require immense quantities for their own domestic projects. Diplomacy is thus burdened with negotiating the flow of sand, and territory, at multiple sites and scales.

To make matters more turbid, the nightmare of coastal reclamation occupies an imaginary and regulatory space created by several misunderstandings about territory itself. These become urgent against both the backdrop of our “oceanic” moment and the apparent dissolution of that idyll of 19th- and 20th-century geopolitical thought, the grounded state.

First among these misconceptions is that territory is a finite and intransigent thing. A longstanding myth of the state, propagated by realist and idealist schools of international relations alike, is the solidity of physical boundaries. In these traditions, the geo-body of the developed nation is thought to be, in the words of geographers John Agnew and Stuart Corbridge, a “set or fixed units of sovereign space.”5 Its peoples and economies were thought to be discrete and independent, its form and extents unchanging. Stranger still, cultures and countries were considered naturally isomorphic. At its conceptual extreme, this involved the conflation, on maps and in cartoons, of the shape of the nation with cultural icons or founding fathers. In Thailand, it was the person of the king, fending off rapacious foreigners. In Italy, it was Garibaldi with a sword. This ignored an untidy fact: that the form of the state has been highly fluid, its edges in particular. Since its invention, the borders of the global map have been continually redrawn. This is clearest, perhaps, in postcolonial contexts such as Singapore, where the reapportioning of territory, and the development of the coastline, had much to do with the play of regional geopolitical strategies.

The difficulty of sand likewise relies on a second error of territorial thought: the reified belief in the state as a unitary actor with sole control over its own space.That is, the state is mistaken for an object, rather than a web of processes. Part of the failure of diplomacy, here, is precisely that it occurs at the “official” level. In reality, the problem ramifies through the myriad actions of substate and supranational actors: dredgers, contractors, developers, ecological activists, overseas investors and property speculators, and politicians at every scale.

Accounts of sand trading, by journalists and advocates alike, articulate terrors arising from the apparent dissolution of national integrity. Milton, for one, relates claims of seedy exchanges between foreign and local elements throughout Southeast Asia. Likewise, a damning 2010 report by environmental watchdog Global Witness describes clandestine dredging of rivers and coastlines, and flotillas of tiny barges carrying stolen ground to undisclosed locations. Erosion, as the undermining of both natural and human ecologies, plays a key symbolic role—it is the geophysical analogue of the “haze,” an annual pollution crisis forced on Singapore and Malaysia by Indonesian slash-and-burn farming. As sociologist Ulrich Beck noted many years ago, these are influences that “add up to an unknown residual risk […] for everyone everywhere.” In the immediate wake of Chernobyl, Beck was quick to point out that the mobility of vectors such as wind-born radiation and pollution—not to mention the contagion of financial disasters—dramatically undermines the notion of an impervious sovereignty. National borders cannot repel such invasions, particularly when the very materiality of those borders is itself in flux.

The complexity of this issue is exemplified by Johor’s Forest City project, the latest episode in the Asian “sand wars.” Clearly, this is a situation in which conditions at a national boundary are changing—much to Singapore’s chagrin. But the controversy also shows how inchoate such works are with respect to the position of the state itself. The venture involves myriad actors, most of them above or below the level of formal governance. The investor, Country Garden Holdings, is a company majority-owned by China’s richest woman, Yang Huiyan. Country Garden’s minority partner is none other than the Sultan of Johor, a regional hereditary ruler. The contractors and sand suppliers are a constellation of private companies. The presumed buyers are global expatriates expected to migrate to Malaysia’s new Iskandar special economic zone, which is currently being built around the existing city of Johor Bahru. In particular, Forest City is positioned to cater to those priced out of Singapore’s condominium market, where high-rise prices rarely fall below 1,000 Singapore dollars per square foot. It is not quite clear who is realizing this new territory; it is almost certainly not “Malaysia” itself.

The challenge of sand is shifting and particular to each site. It articulates a nightmare both old and new: a

radically liberated state, free of stabilizing ideologies such as soil and ground

. Sand is an unstable and promiscuous alternative, quickly drained of historical and geographical traces. Perhaps it is telling that in Hebrew “sand” and “secular” are homonyms. It holds allegiances to no nation, no religion. Its form is transience. The fear goes: there is no more land; there is only sand.

http://www.seasteading.org/forum-list/topic/what-defines-a-seastead/page/11/#post-25283

Big things have small beginnings - oceanic business alliance

article source:

Built on Sand: Singapore and the New State of Risk - Harvard Design Magazine

Ocean colonization, concrete honeycomb shell construction - oceanic business alliance

Singapore sand sourcing, liquid real estate, sand for Singapore, landfill real estate, sand sources for Singapore all over Asia.

Sand business is worth USD 70 billion per year !

freedom of the seas / seastead independence / ocean zones /

The big five business fields of ocean colonization: | oceanic transport | oceanic energy | oceanic real estate | deep sea mining | oceanic aquaculture |

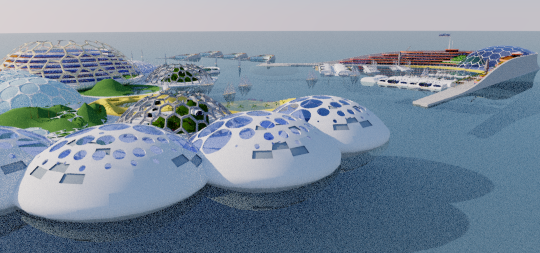

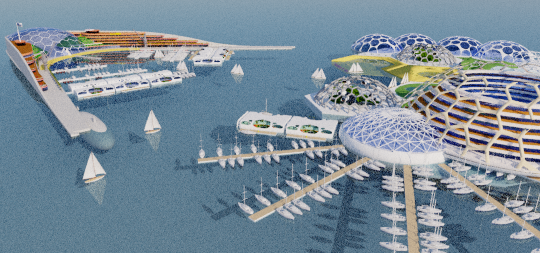

![]() | advanced cement composite shell floating structures |

| advanced cement composite shell floating structures |